Sheikh Taposh’s magic money tree

Why a dubious fish farm, which catapulted Awami League’s mayoral candidate for Dhaka South, into the category of Bangladesh’s super rich, requires investigation.

Becoming a ruling party MP in 2008 was a ticket to wealth for Sheikh Fazle Noor Taposh, the Awami League’s mayoral candidate in Dhaka South City Corporation elections. His mandatory disclosures to the Election Commission (EC) over the last twelve years not only show how Sheikh Taposh amassed massive wealth but also raise questions about how he managed to do so within just a few years. A review of the EC disclosures and other financial documents by Netra News flag Taposh’s investment in a new private bank and his curious ownership of a mysterious fishery.

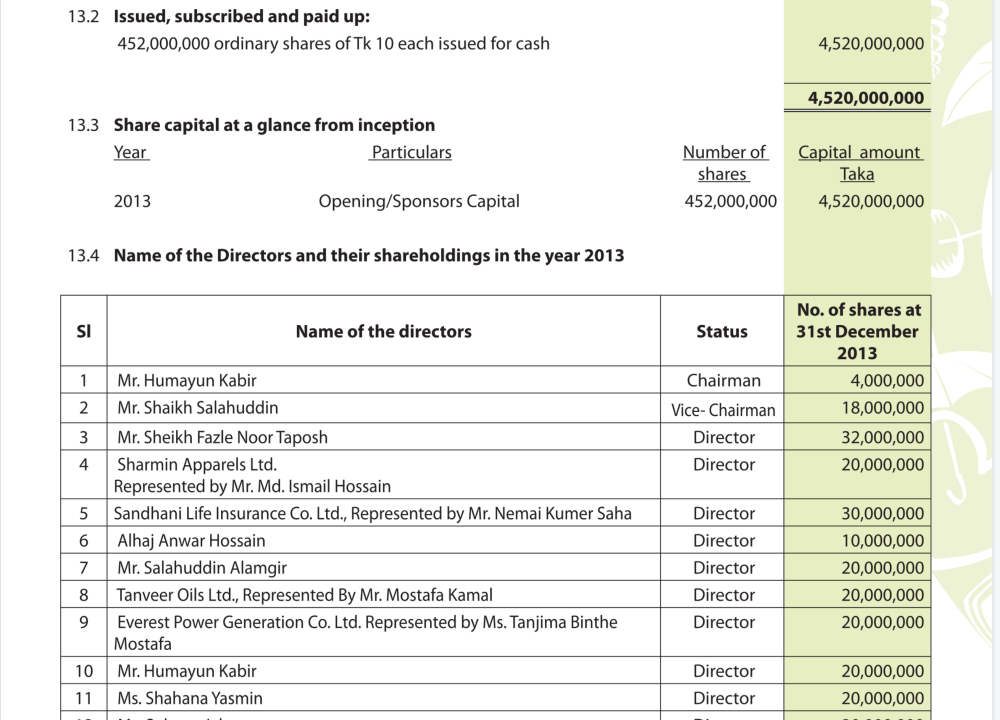

That Sheikh Taposh had a jaw-dropping increase in his wealth between 2008 and 2013 was earlier reported in the Bangladeshi press. However, under-reported was his investment in Modhumoti Bank, which opened in 2013, with Taposh (then the MP for Dhaka-12) as its largest shareholder owning 32 million shares. With each share priced at Taka 10, he had spent Taka 32 crores (around $3.8 million) for the shares.

How did Sheikh Fazle Noor Taposh, who had a total annual income of Taka 22 lakhs ($26,000) and movable assets worth about a little more than Taka 1.6 crore ($177,000) in 2008, become the principal sponsor of a new private bank in 2013 and also increase his immovable assets like real estate (which were worth just a few crores in 2008)?

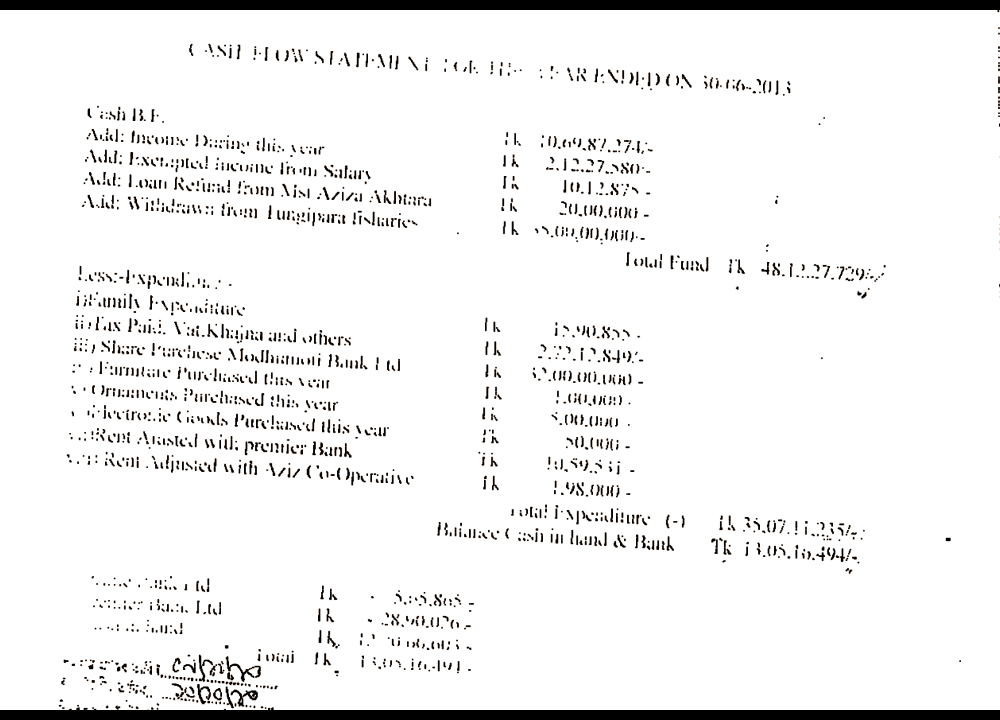

The answer to this question lies in an attachment to his 2013 disclosure to the EC containing his income tax certificate for the year 2012/13. In it, Taposh suggests that he paid for the Modhumoti Bank shares by “withdrawing” Taka 35 crores ($4.1 million) from an entity called Tungipara Fisheries. However, the very existence of such a fishery is dubious.

According to his disclosures to the EC, Taposh acquired Tungipara Fisheries sometime between 2008 and 2013. His 2013 disclosure values his stake of the firm at Taka 12.9 crores ($1.5 million) and suggests that his wife’s stake was Taka 1.3 crore ($153,000). As he was able to remove Taka 35 crores from the firm in 2012/13 to sponsor a new bank, at some point it was worth at least Taka 48 crores ($5.6 million), making it one of the biggest fish farming ventures in the country. There is no indication in the disclosure that such a big firm gave the MP any income for that year as he left the “income from business” column blank.

Netra News researchers spoke with three individuals with close ties to fishing trade in the district of Gopalganj. None of them were able to confirm the existence in the past or present of a fishery in Tungipara Upazila that would fit the description of Taposh’s fishing venture. “In [neighbouring] Kotalipara, there are well-developed fisheries that can generate revenues of upto 1-2 crores a year, Tungipara has had nothing like that, to the best of my knowledge,” a part-owner of a local fishery told a Netra News researcher. There is no entity in the Bangladeshi business register which exactly matches the name of Tungipara Fisheries, though there is one called Tungipara Agro Fisheries & Hatchery (Pvt.) Ltd.

A similar inquiry into the existence of Sheikh Taposh’s fish business was earlier made by the Prothom Alo newspaper. On December 23rd 2013, the newspaper published a story detailing how 21 candidates in the 2014 parliamentary election owned fisheries. One of those politicians was Sheikh Taposh. At that time, Prothom Alo reporters were told by his assistant Tareque Sikder, who was speaking on behalf of Taposh, that the MP and his wife owned a fishery in Tungipara. The assistant, however, was not able to say where in Tungipara the fishery was located or how large it was.

Prothom Alo reporters also spoke to an officer at the Gopalganj district fisheries office, who told them there was no large hatchery in Tungipara. The fisheries office did not have any record of any private investment made by Sheikh Taposh into fish farming. The fisheries officer told the reporters that it was impossible for a fishery in Tungipara to generate even Taka 1 crore in annual revenue.

In its story, Prothom Alo cited sources in the National Board of Revenue (NBR), tax lawyers and people involved in fish farming to report that ostensible investments in the fisheries sector are often used as a tool of whitening illicit money. Anyone could pay 3% tax on such investments and whiten their ill-begotten income through a tax loophole applicable for fishing farms.

“Fisheries business has long been a convenient justification for tax evasion and accumulation of wealth disproportionate to legal income,” the executive director of Transparency International Bangladesh (TIB) Iftekharuzzaman told Netra News. “The problem is a result of an apparently deliberate policy gap which is often taken advantage of by many publicly exposed persons.”

This is a possible explanation for Sheikh Taposh’s claimed foray into the fish trade, as it enabled him to show a legitimate origin of the funds he used to buy the shares of Modhumoti Bank.

This was necessary, as according to the Bangladesh Bank’s guidelines for establishing a bank in the country, Taposh’s contribution “to the equity capital” of the bank was “required to be out of [his] net worth declared to the tax authorities” and it could not “be from contribution out of borrowings from bank or non-bank financial institution.” What this meant was that in order to become an investor in a new bank, Taposh had to show to the central bank that he had Taka 32 crores ($3.8 million) from a supposedly lawful business. The mysterious Tungipara Fisheries seemed to have served his purposes at the time. His latest EC disclosures in 2018 and 2020 do not contain any reference to the fishery anymore.

When asked to comment on these findings about Sheikh Taposh’s finances, the executive director of TIB, Iftekharuzzman, told Netra News that the anti-corruption authorities should investigate, “It will be incumbent upon the relevant authorities including the Anti-corruption Commission to investigate whether there is any disproportionality of the reported financial wealth with legitimate sources of income.”

Modhumoti is one of the nine banks that were given licence to operate by the Bangladesh Bank in 2013. Almost all of these had sponsors with strong ties to the ruling Awami League, and some of the sponsors were members of parliament. At that time most financial commentators did not recognise any economic need for new banks, and the move was perceived by many as a way for the Awami League government to reward party stalwarts. Fahmida Khatun, the executive director of Centre for Policy Dialogue (CPD) has subsequently said that these private banks have simply “become a tool for misappropriation of public money.”

Modhumoti Bank, with Sheikh Fazle Noor Taposh as its main sponsor, began operating in June 2013. Indeed, the purchase of the Modhumoti shares catapulted Taposh, a close relative of Sheikh Hasina, into the category of the super rich in Bangladesh. On the basis of the bank shares he bought in 2012/13 alone, he now earns an annual income of around Taka 7.8 crores ($919,000) that far outweighs the other income he earns as a lawyer (Taka 1.4 crore/$165,000), landlord (Taka 42 lakhs/$50,000) and MP (Taka 6.6 lakhs/$7,800).

Netra News emailed and texted Sheikh Fazle Noor Taposh asking him to explain the actual source of the funds he used to buy shares of the Modhumoti Bank. We also tried to contact him on his phone and left messages, but have not received any response.

We also emailed and texted the Anti-Corruption Commission (ACC) of Bangladesh to inquire if the anti-corruption body would investigate whether the source of the funds used to become the largest sponsor of the bank was legitimate. We did not receive a response from the ACC at the time of publication.

Sheikh Fazle Noor Taposh, the Awami League’s mayoral candidate for Dhaka South, now has Taka 26 crores ($3 million) in cash (he had Taka 98 lakh/$185,000 in cash in 2008); Taka 1.5 crore ($177,000) in bank and NBFI deposits (he had Taka 2 lakhs/$2,400 in bank and NBFI deposits in 2008); Taka 35.2 crores ($4.1 million) in fixed deposit (he had Taka 31 lakhs/$36,000 in fixed deposit in 2008); and, jewellery worth Taka 1 crore ($118,000 — he had jewellery worth Taka 6 lakhs/$7,000 in 2008). Among his newly acquired immovable assets is a 5-storied building worth Taka 3.3 crore ($389,000) in the prime location of Banani.●

🔗 প্রথম আলো, প্রার্থীদের হলফনামা: মৎস্যজীবী রাজনীতিবিদ (২৫শে ডিসেম্বর ২০১৩)