Beyond Crisis

In the first of our “Bangladesh at 50” series, Jyoti Rahman looks at how successive finance ministers managed the country’s economy over five decades

Bangladesh was founded with the promise of political freedom, but democracy was derailed in 1975, restored through a popular uprising in 1991, and has been stagnating ever since, buffeted by political instability. While there is disagreement about the details, most readers will be familiar with this general narrative of Bangladesh’s political history.

A considerably different picture emerges when we look at the past 50 years through an economic prism. Bangladesh was founded with the promise of economic freedom, but freedom was accompanied by an economic collapse, a sustained economic recovery starting in 1975, and a remarkably stable economy since 1991 — a less understood narrative.

Instead of the usual history based on the presidents or prime ministers and their parties, we are going to explore how successive finance ministers have approached economic challenges in four distinctive eras: of worsening crisis (1971‑75); of reconstruction (1975-90); of broad‑based growth (1991-2006); and, of oligarchy (since 2007).

Seeing the country’s history through an economic lens should cause a reappraisal of some individuals’ achievements and a reassessment of past events. More importantly, a better understanding of the past would, one hopes, help us prepare for a future crisis.

1971-1975: Great leap backwards

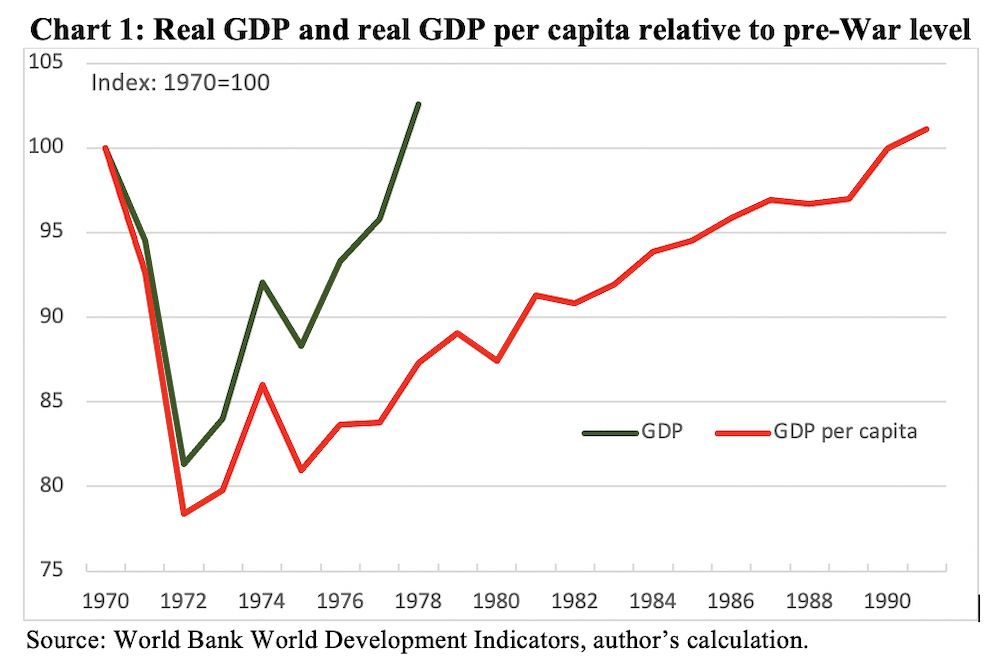

The debate around the precise numbers of victims of genocide and other atrocities notwithstanding, the human tragedy of Bangladesh’s Liberation War is well appreciated. Relatively less recognised is the economic effect of the war, even though arguably there are better documented quantitative estimates of the war’s material costs. East Pakistan was already one of the poorest places in the world in 1970. The war had left the average person in the country a fifth poorer than their pre-war level (see Chart 1).

Mansur Ali was the country’s first finance minister. But the task of post-war reconstruction fell to Tajuddin Ahmed, who became the finance minister in January 1972 upon Sheikh Mujibur Rahman’s return from Pakistan.

Tajuddin faced a colossal task. There was hardly any road, railway track, bridge, jetty, telephone or power grid, airstrip or any other transport and communication network which was undamaged in 1972. Crops and produce could not be taken to markets, and in many places, markets were burnt down or destroyed. Workers and businesses alike were affected by the displacement of tens of millions of people.

To make things worse, the economy was hit with two adverse shocks — in the aftermath of the October 1973 Yom Kippur War, an oil embargo imposed by Arab oil producers resulted in global inflation and recession, and then in 1974, there was severe flood.

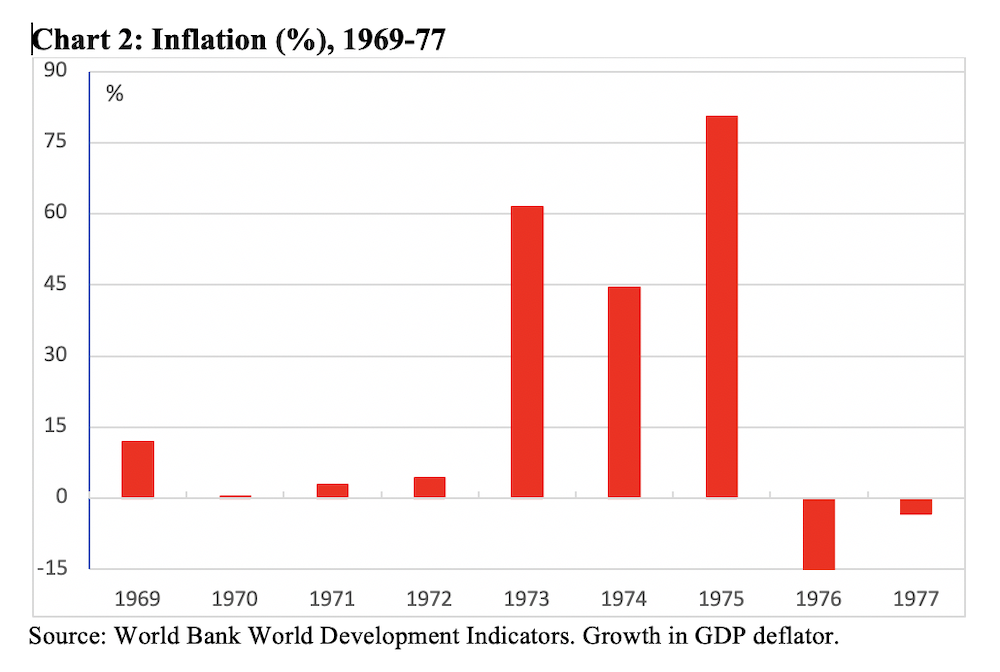

The result was unprecedented inflation, with prices rising four-fold between 1972 and 1975 (see Chart 2), and a famine in 1974 — the first since 1943 — that left tens of thousands dead.

That is, instead of recovering, the war-ravaged economy tracked backwards under Tajuddin’s watch. Of course, not everything about the economic calamities of the early 1970s was Tajuddin’s fault. But much of it was.

Before the war, most of the country’s banks, businesses, and factories were owned by West Pakistanis. These were abandoned by their owners when Dhaka was liberated. Instead of being distributed among Bangladeshi entrepreneurs, they were nationalised. In fact, in the name of socialism, the government nationalised Bangladeshi-owned businesses too.

Now, from the vantage point of 2021, the nationalisation-mismanagement-shortages-crisis turn of events might seem rather predictable. But things were not so clear cut in the early 1970s. Well qualified economists had written volumes about the government capturing the “commanding heights” of the economy to give a necessary “big push” towards development.

The issue was not so much socialism as such. Socialism might have sounded feasible in theory. But to work in practice, socialism needed qualified and dedicated bureaucrats and managers. And even socialist economies needed to finance their budgets and pay for imports. Tajuddin’s failure was on both counts.

The relatively few Bengali professionals who reached executive positions in Pakistan despite discrimination and prejudice might have been expected to play a key role in the reconstruction, whether under socialism or in a more market-oriented system. However, most of these experienced bureaucrats and managers were shunned post-war for being alleged collaborators. Instead, jobs were given to Awami League loyalists, regardless of qualification or merit.

To be sure, the culture of appointing party loyalists to jobs was nothing particularly unique to the government that Tajuddin was part of. However, as a veteran politician with an acute understanding of the country’s political culture, the finance minister should have understood the ramifications of nationalisation in post-war Bangladesh. He clearly failed to do so.

Tajuddin also failed to appreciate the basics of public finance and macroeconomics. The new country lacked foreign currency to pay for imports, particularly food and oil. And the government lacked revenue to cover its expenses. External finances, in the form of grants and concessional loans, were available from western countries and international financial institutions. On ideological grounds, Tajuddin refused to avail the country of these.

Tajuddin Ahmed’s role as the war-time prime minister is recognised widely, and he is justly mourned as a victim of the tragic jail killing of 1975. But as a finance minister, he was a colossal failure.

1975-1990: All the presidents’ men

Of course, ultimately Tajuddin was not the head of the government, and the proverbial buck stopped with the prime minister, then the president. However, at least as far as basic economic management was concerned, things improved from early 1975, when AR Mallick was appointed as the finance minister.

Mallick continued to serve in the position until November 1975, when the military administration appointed Mirza Nurul Huda as the country’s de facto finance minister. Huda would eventually be appointed to that position formally in 1979, and replaced by Saifur Rahman briefly in the early 1980s. Saifur was followed by AMA Muhith, M Sayeduzzaman, Wahidul Huq, and Major General MA Munim in the post during the 1980s.

Huda had served as East Pakistan’s finance minister in the 1960s. Saifur and Muhith would go on to serve as finance ministers under Bangladesh Nationalist Party and Awami League governments respectively after 1991. The rest of these men could be best described as technocrats. The seven men had very different political dispensations and personalities.

But they had two things in common. First, each was a successful professional before becoming a minister or joining politics. And second, they were committed to do whatever was necessary to avoid a repeat under their watch of the early 1970 economic collapse.

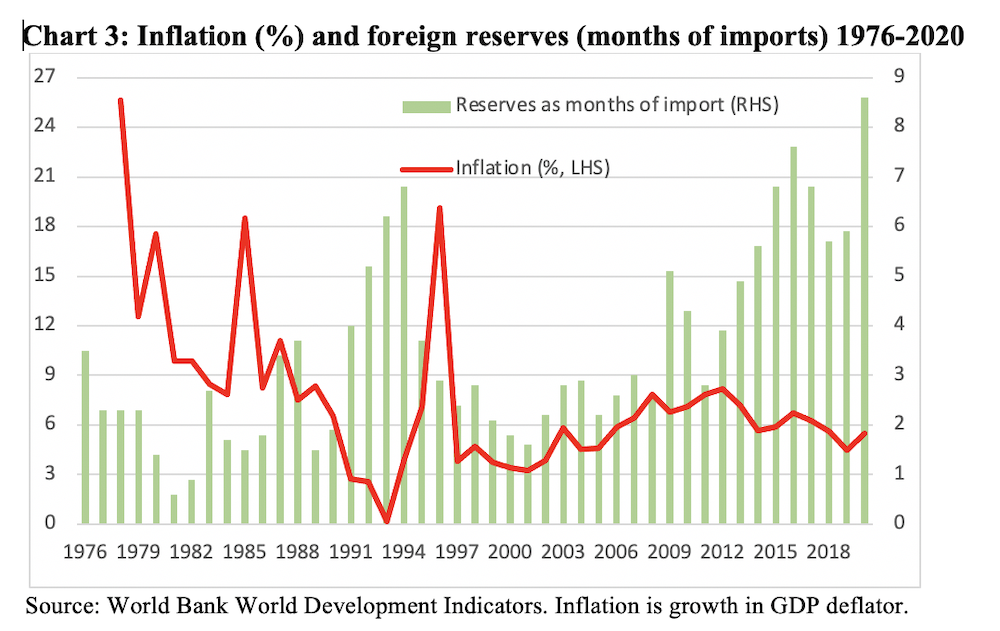

And they were successful in avoiding an economic crisis, despite several risky episodes. Two metrics illustrate their success: inflation and foreign reserves.

In developing countries that need to rely on imported essentials such as food or fuel, foreign exchange reserves held by a country’s central bank is a key indicator of economic vulnerability. When foreign reserves run below the level needed to pay for three months of import, the country is considered at risk of not being able to meet international obligations. Policy solutions often involve devaluing the country’s currency, to allow its exporters a competitive advantage. The trade off is that with a devalued currency, imports are more expensive, and there is inflation.

One can see more readily how inflation can add to citizens’ woes. Inflation can arise from a number of different kinds of adverse shocks to the economy, from natural disasters to supply chain disruptions caused by political instability at home or abroad. However, ongoing inflation that spirals out to manyfold rise in prices — this is almost always and everywhere a sign of economic mismanagement by the government.

As Chart 3 shows, throughout the 1980s, foreign reserves dipped repeatedly below the three months of import threshold, sometimes falling so low as to not covering even a month of imports! Meanwhile, there were inflationary episodes. That is, there were several close calls, but these episodes never turned into a full-blown crisis. Prices never spiralled out the way they did in the early 1970s. There was no famine..

It was not that the context of the task of these finance ministers was any easier than Tajuddin’s. In 1975, GDP was still 12% below the pre-war level, and the average person still earnt only four-fifths of their pre-war income. On top of that, the country reeled from coups and counter-coups that would see two presidents and scores of others assassinated. Floods hit the country in 1984, 1987, and 1988. And there were global shocks, such as the oil price spike in 1979 after the Iranian revolution.

From Mallick to Munim, the seven men serving different presidents managed these economic challenges with a mix of deft fiscal, monetary, and exchange rate maneuvering. They eschewed ideology and accepted international assistance that was available, maintained austerity as needed, and ran the government machinery and state-owned enterprises as efficiently as they could by appointing people based on competence.

The macroeconomic stability achieved after 1975 afforded successive governments the breathing room to tackle poverty. Food-for-work and family planning policies were pursued more efficiently, and the rural economy was helped by the green revolution. The Gulf labour market opened up. With government support, the readymade garments industry found a footing. Recognising that the state was unable to meet the needs of the citizens, NGOs were allowed to fill the gap.

All these helped. None would be possible had there been another 1974-style crisis.

Most of these seven individuals are now forgotten. This is unjust. Bangladesh was still a desperately poor place as the 1980s ended as real GDP per capita would only reach the pre-war level in 1990. But the economy, and society, did not collapse.

These seven finance ministers deserve our gratitude for keeping Bangladesh afloat.

1991 – 2007: Rising tide lifting many boats

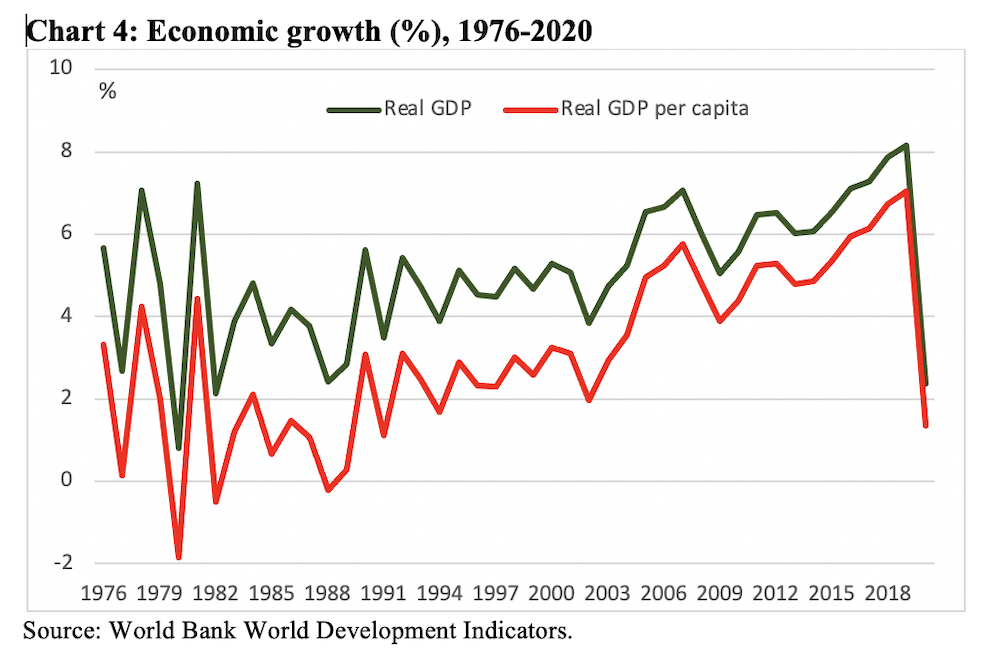

The conventional wisdom is that the period between 1991 and 2007 was an era of wasted opportunity as democracy suffered from bitter political conflict between the country’s two parties (and their leaders). However, from an economic perspective, the period can be seen as an era of bipartisan continuity that lifted millions out of poverty.

The twin engines of remittances sent by migrant workers and the exports earning from the garments sector boomed in the 1990s. They were supported by the NGOs, many of which were by now becoming corporate groups. Upon returning as the BNP finance minister after the 1991 election, Saifur Rahman put together a policy programme to govern the economic boom.

Tax reforms and privatisation of loss-making businesses were supposed to put the public finances on a sound footing. Reforms of commercial laws and regulations were meant to make it easier for entrepreneurs to start their ventures. Trade liberalisation introduced competition in the domestic market, helping consumers and more productive firms alike.

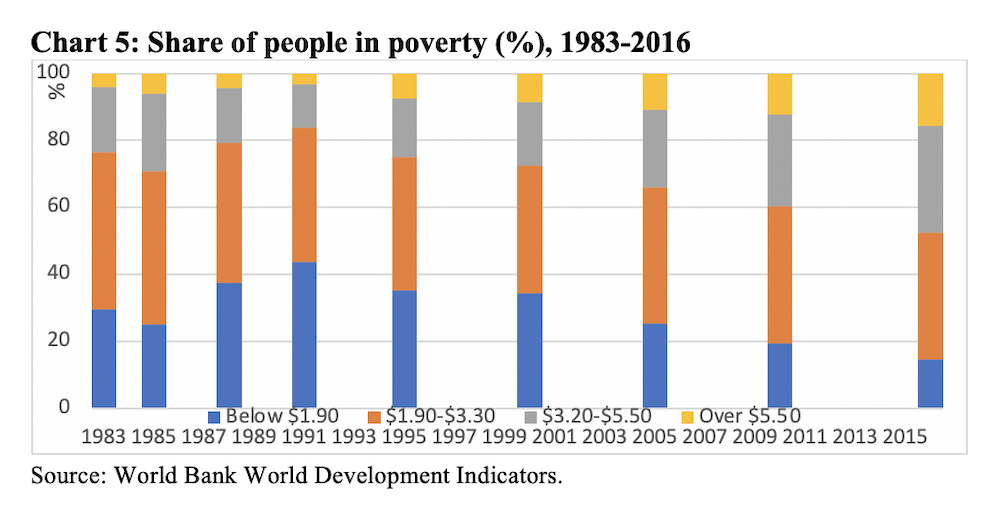

Each of these policies were continued, and often enhanced, by Awami League’s SAMS Kibria after the 1996 election. The result was a steady increase in economic growth (Chart 4), which has seen average income rise more than three-fold since the early 1990s, and the share of people living in poverty fall (Chart 5).

Arguably, Kibria faced a tougher challenge in the form of a stock market bubble and crash (1996), the Asian financial crisis which put pressure on the exchange rate (1997), and a devastating flood (1998). The economic mismanagement of the early 1970s was not forgotten by those who lived through it. But this time round there was no crisis. Indeed, Kibria’s party would be able to reap electoral benefits from his stewardship of the economy, though he would not live to see it.

Saifur returned to a third stint as finance minister after the 2001 election. While the economy continued to grow, by the mid-2000s, it was suffering from growing pains. Rising income had meant increased demand for electricity, as households wanted to charge their mobile phones and gadgets, while factories wanted to run 24-hours to meet their export orders. More people could afford motor vehicles than ever before. But the country’s infrastructure had not kept pace.

Bangladesh needed more electricity power plants, and roads-bridges-railways. The issue was not financing as such. Multilateral development banks and foreign governments were willing to fund the projects. And even if they had not, by the mid-2000s Bangladesh had enough domestic capital to finance the needed infrastructure. The problem was one of governance.

Infrastructure projects are long term propositions involving huge sums of money. On the one hand, the investor needs certainty that the projects would survive political change. On the other hand, if there is assurance of political continuity, these investments generate large returns. The textbook solution prescribed by economists is to set up a transparent legal framework and institutions to govern these projects.

Just as socialism was not a practical idea in the 1970s Bangladesh, the good governance prescription did not meet the reality of Bangladesh after 2000. The country’s burgeoning oligarchs wanted to maximise their pay off from the infrastructure boom. Saifur Rahman failed to find a way that would satisfy the oligarchs. Mirza Azizul Islam, the finance advisor in the ill-fated caretaker regime backed by the de facto coup of 2007, was out of his depth.

It would be Awami League’s AMA Muhith, with the full backing of his prime minister, who would usher in the next era of Bangladesh’s economy.

New Deal

Muhith had served as a technocrat finance minister under the military regime of Lieutenant General HM Ershad in the 1980s. He was reappointed to that position after the election of 2008. He continued, at least initially, with the fiscal, monetary, exchange rate, trade, and microeconomic policies of Saifur and Kibria.

In addition, he offered — or acquiesced to his prime minister’s decision to offer — the oligarchs a new deal: support the government in its political games, and you would have access to the infrastructure mega projects and other business opportunities without oversight.

Take electricity for example. Rental power plants were set up to generate power quickly to meet demand. But terms and conditions were such that the tycoons could scheme off a fortune. And parliament passed a law prohibiting anyone from investigating the matter.

Or take banks. Political cronies were allowed to set up banks without proper governance frameworks. Ditto media houses. Ditto share market manipulation and bust of 2011.

By the end of the 2010s, the regime had become ever more reliant on the bureaucracy and security apparatus of the state. To ensure their loyalty during the fraudulent 2018 election, there was a large fiscal expansion in the preceding years.

The economy continued to boom. By the late 2010s, most Bangladeshis enjoyed a living standard that was unprecedented in history. And the oligarchs backed the government in its suppression of political opponents. One of them, AHM Mustafa Kamal, became the finance minister in 2019.

On a sticky wicket

As the new decade began, Bangladesh had all the hallmarks of a country at risk of an emerging market (read: crony capitalist) crisis. The fiscal largesse of the previous decade had resulted in sharp rise in imports, while banks were reeling from non-performing loans.

Many developing countries had floundered at a similar junction. Maybe it would be a bank run. Maybe it would be a sharp exchange rate depreciation. Perhaps the oligarchs would fall out over the spoils and trigger a mafia-style turf war. If nothing else, crony capitalism crowds out innovation and entrepreneurship everywhere else, why would Bangladesh be any different?

As it happened, the economy was hit with the Covid-19 pandemic in 2020, the aftereffects of which are far from clear.

There is no question that the pandemic, and the associated lockdowns, have hit the economy harder than at any time since the late 1980s. However, the pandemic has also given Kamal an alibi and a lifeline to extricate the regime he serves from the swamp that has been created over the past decade.

Much would, of course, depend on how the world economy behaves out of the pandemic.

As a cricket administrator, Kamal would be familiar with the term on a sticky wicket, which refers to a pitch that is moist from rain. It is hard to bat on such a pitch because the ball bounces unpredictably. The post‑pandemic world economy is as uncertain as any sticky wicket Kamal would have seen in his time. Faced with that uncertainty, the current finance minister would do well to follow in the footsteps of all the finance ministers from Mallick to Kibria, and stick to fiscal discipline and tight economic management.

Of course, the wicket can dry out, and become a batter’s paradise. It may well be the case that the world economy booms after the pandemic. In that scenario, Bangladesh could continue to sell its cheap labour, and the oligarchs can continue to reap the dividends of the infrastructure boom for years to come.

Time will tell.●

Jyoti Rahman is an applied macroeconomist. His analyses are available at www.jrahman.substack.com