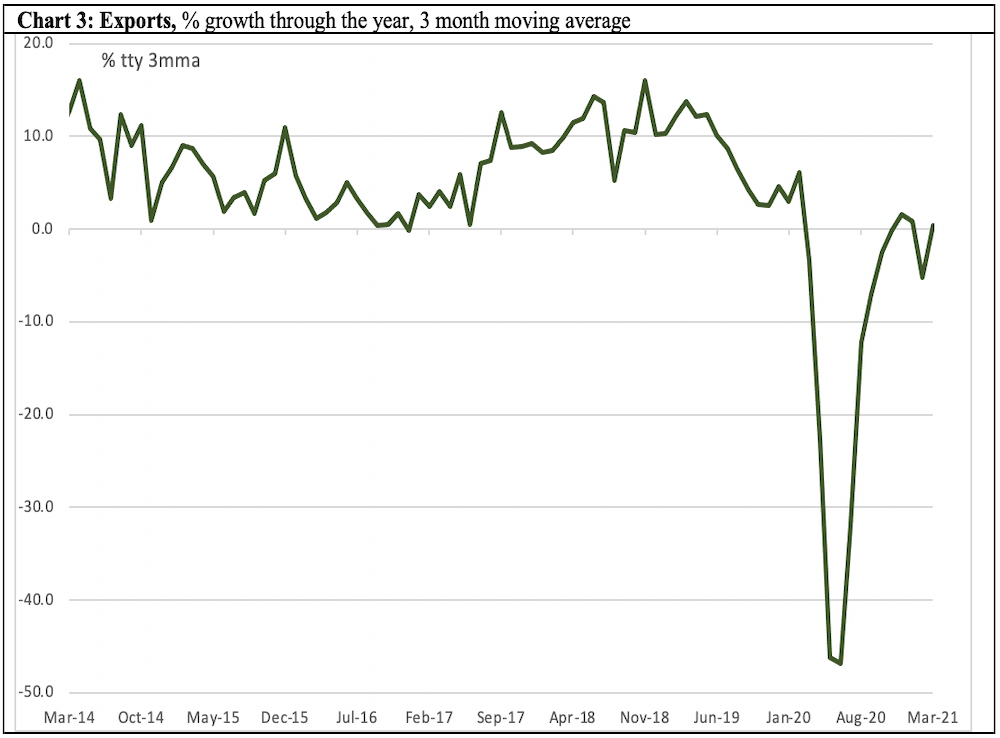

Indicators suggest beginnings of economic recovery

Our economic chart series continues, with imports, tax revenues, and other indicators suggesting positive signs for Bangladesh’s economy.

This is the second edition of our set of 18 charts about the Bangladesh economy, with three months of further data.

For more about the purpose and background of the charts and about the significance of each indicator, read the first article here.

According to the recently announced 2021-22 budget, the economy is supposed to have grown by 6.1% in the 2020-21 financial year. In contrast, the Asian Development Bank is more bullish, with a growth forecast of 6.8%, while the World Bank is far gloomier, projecting only 3.6% growth for the year.

Our charts suggest that there are positive signs, but also grounds for caution.

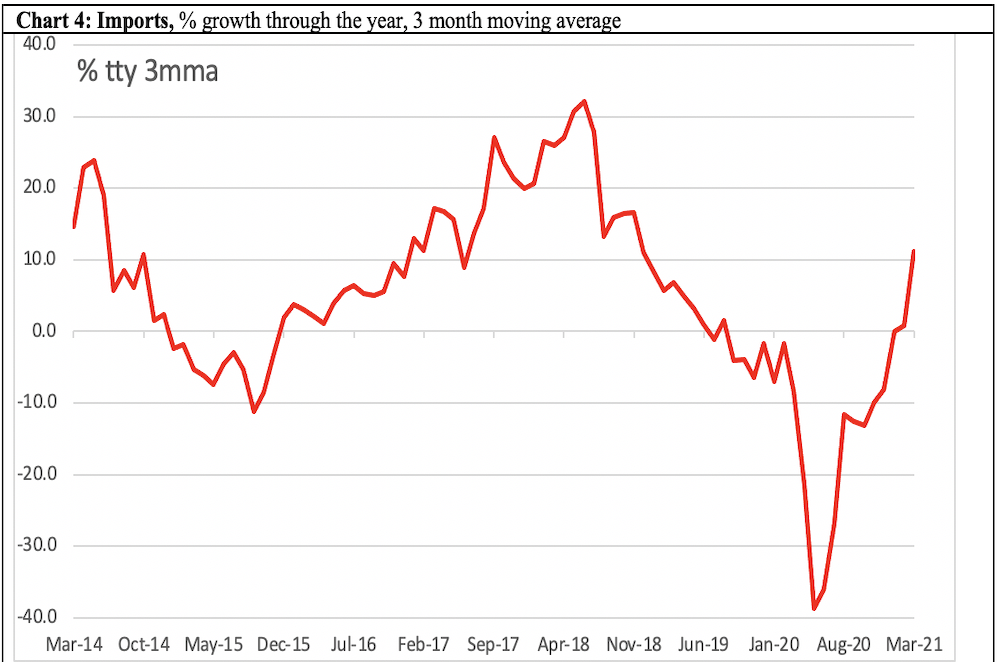

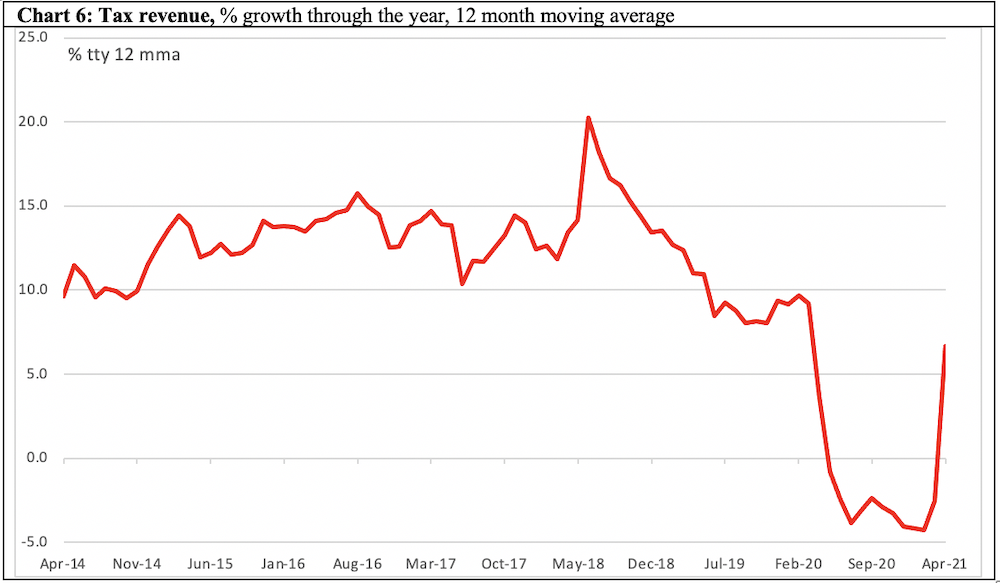

The most significant positive changes in the last three months are:

— imports growing by 11% in the year to March 2021;

— tax revenue growing by nearly 7% in the year to April 2021;

— remittances continue to grow; and

— over 90,000 workers left for overseas in March-April.

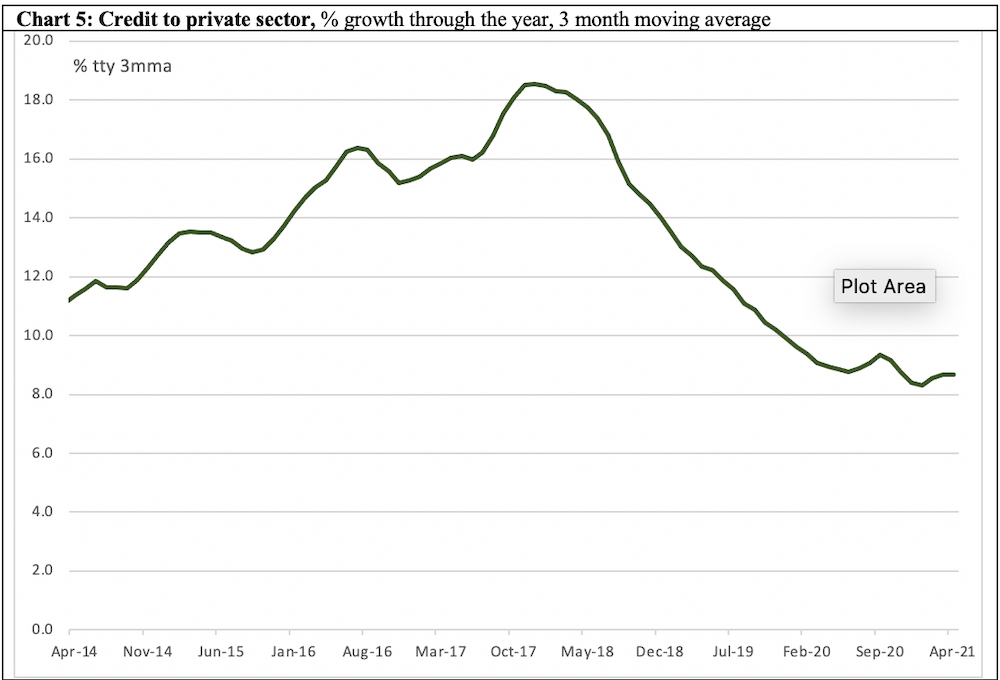

However, the recovery is far from guaranteed, as:

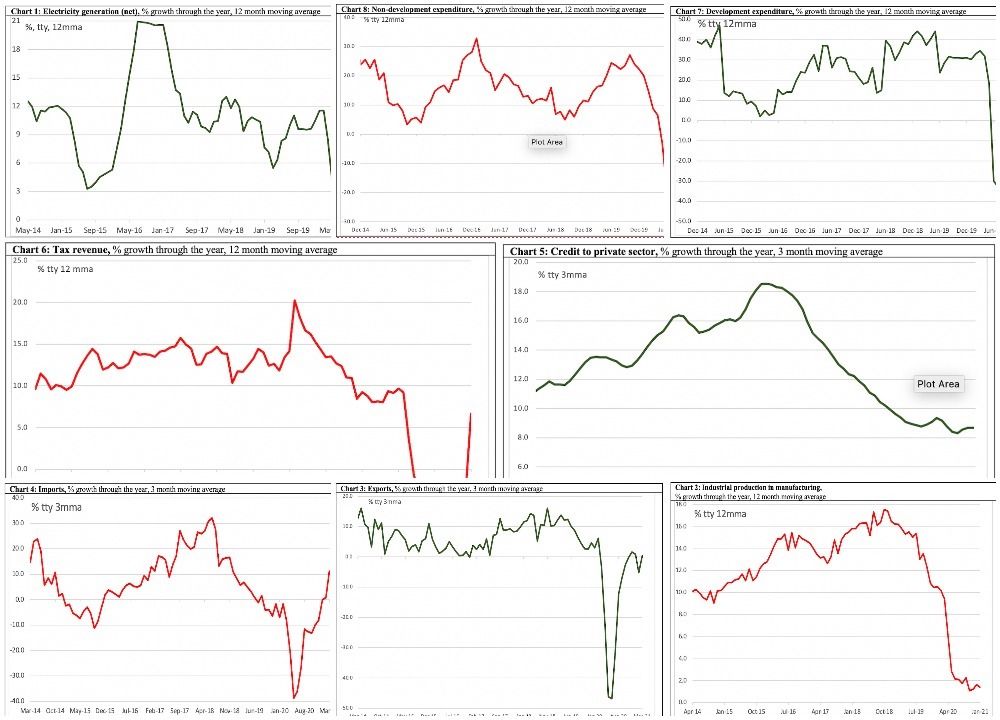

— electrical generation remains low;

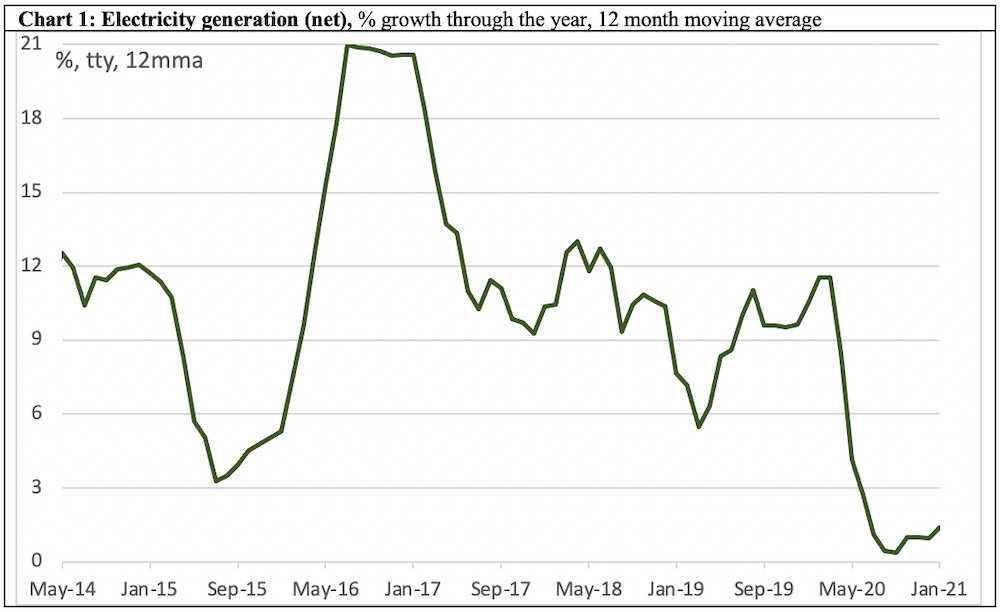

— very minimal growth in industrial production;

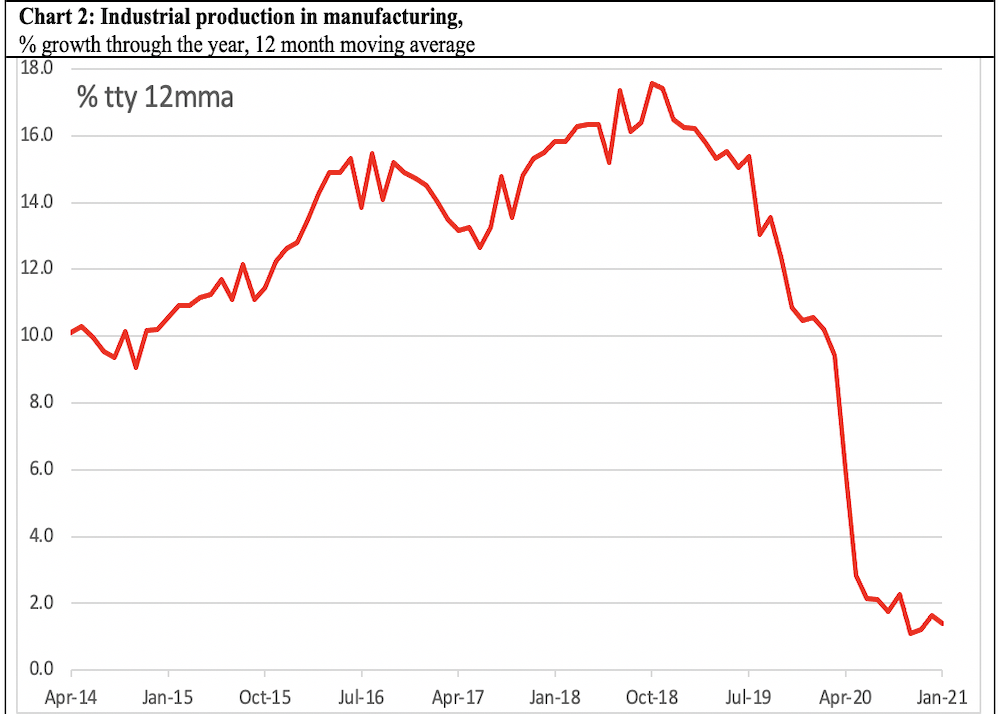

— minimal growth in exports; and

— credit to private sector still slowing down.

Importantly, these indicators do not fully take into account the pandemic wave of April-May.

Chart 1: Electricity generation

The indicator grew by only 1.4% in the year to January 2021, in contrast to prior to Covid-19,when electricity generation was growing by 9-11%.

Chart 2: Industrial production

This indicator shows very minimal growth of 1.4% in the year to January 2021.

Chart 3: Exports

Exports grew by 0.4% in the year ending March 2021.

Chart 4: imports

Imports grew by 11% in the year to March 2021, possibly suggesting an incipient economic recovery.

Chart 5: Credit to private sector

Growth in credit to private sector continues to slow, not having clearly bottomed out as April 2021.

Chart 6: Tax revenue

Tax revenue grew by nearly 7% in the year to April 2021, possibly pointing to an economic recovery.

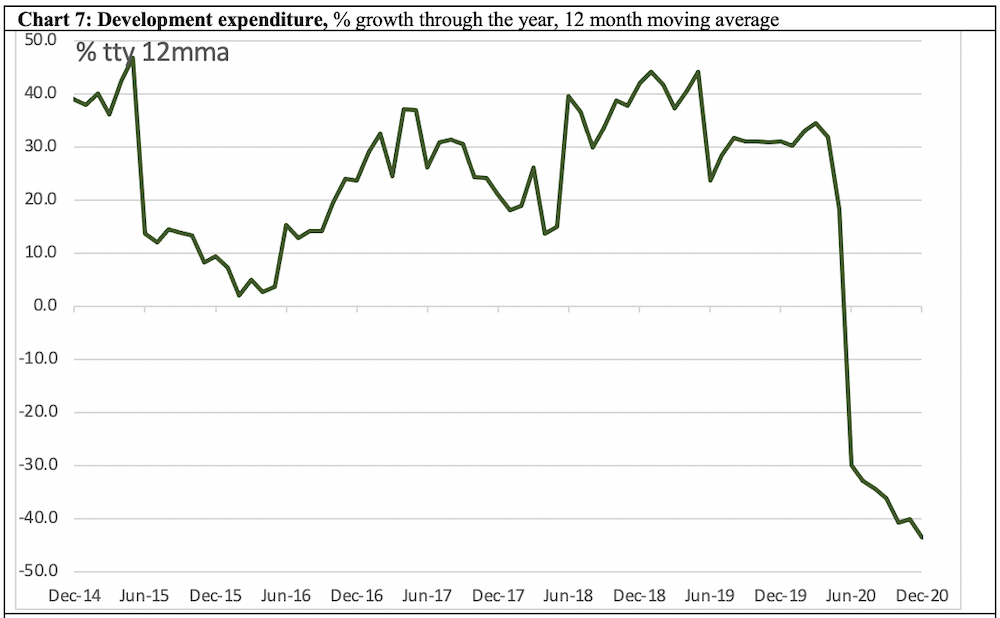

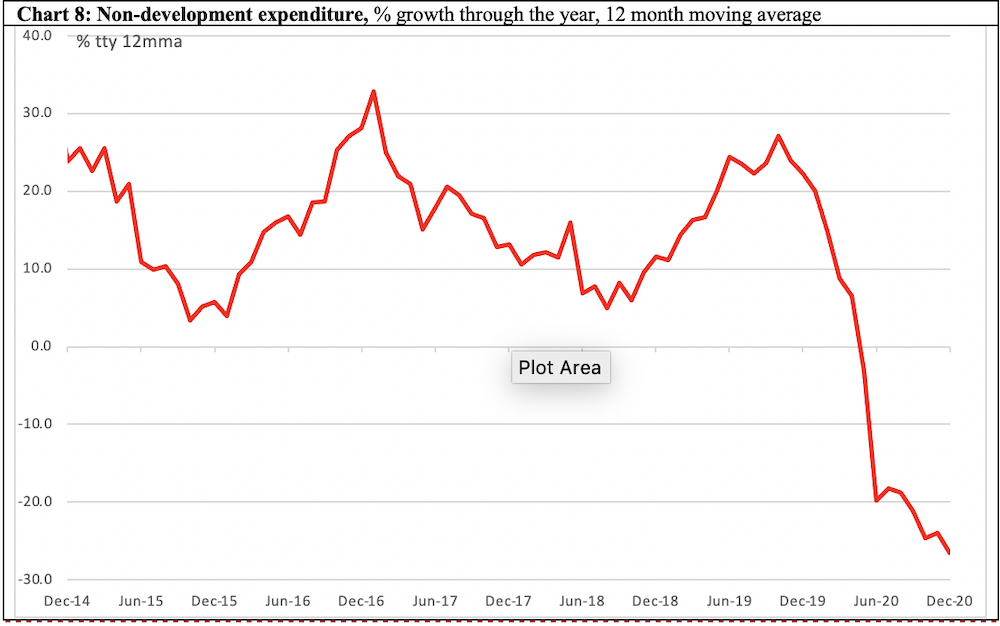

Charts 7 and 8: Development and non-development expenditure

Both indicators collapsed during the lockdown, and neither appeared to have bottomed out as of December 2020.

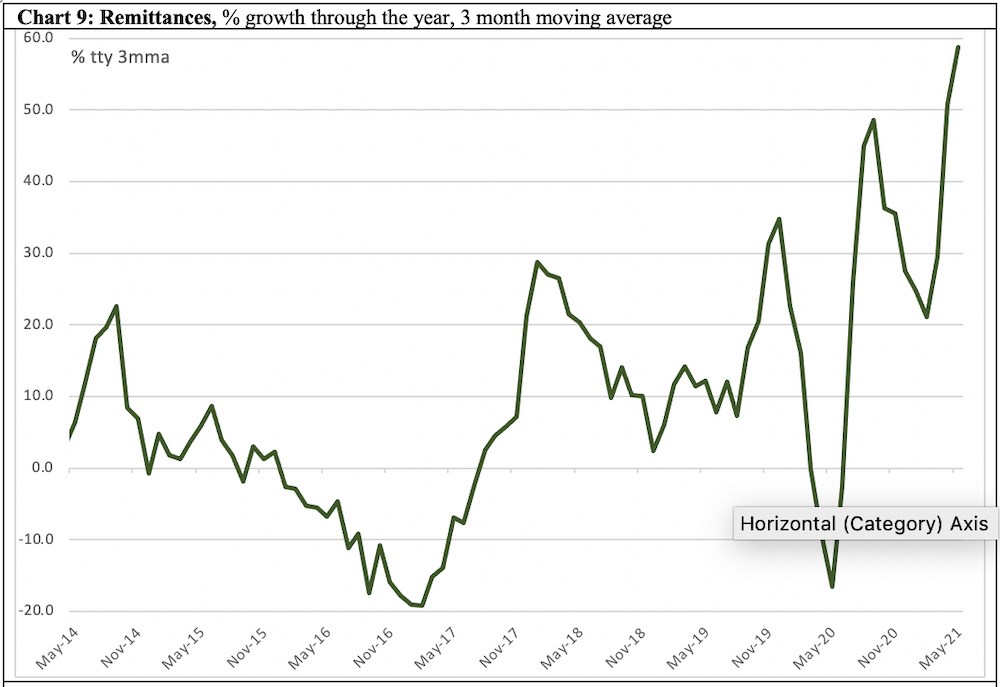

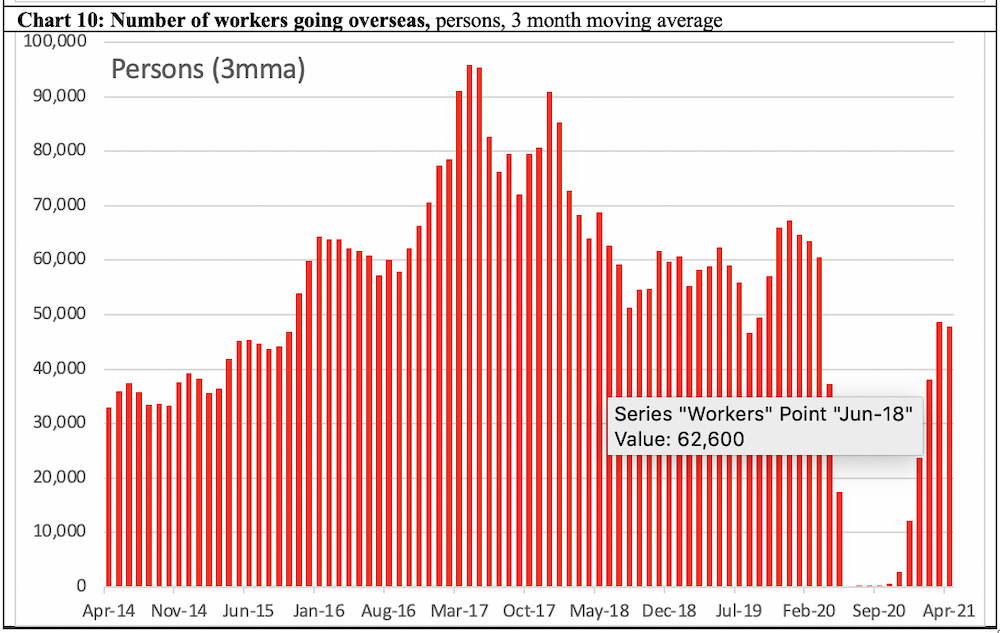

Charts 9 and 10: Remittances and Overseas Workers

Remittances continue to grow and with over 90,000 workers leaving for overseas in March-April, these indicators are suggestive that a recovery might have started.

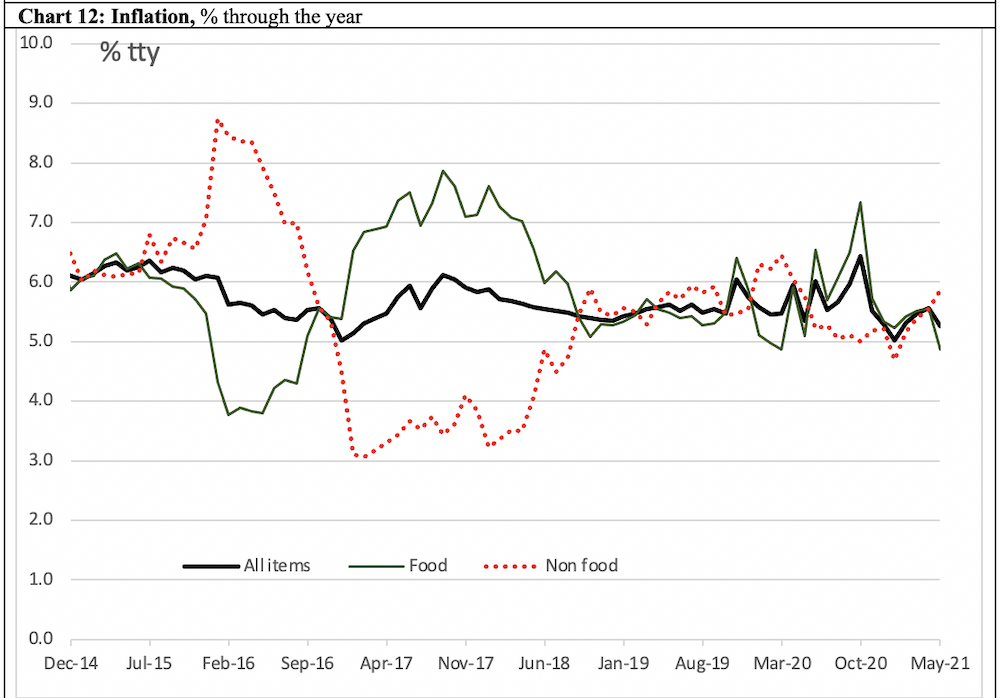

Chart 11 and 12: Wage rate index and inflation

Wage rates grew by 6.4% in the year to May 2021, a similar pace as that prevailing before the pandemic. Inflation remains moderate till the year ended May 2021.

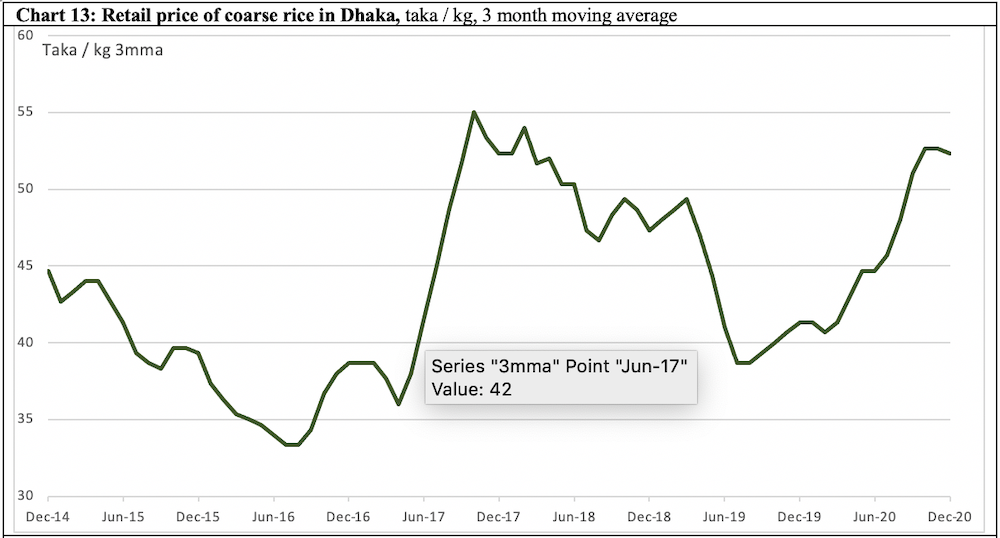

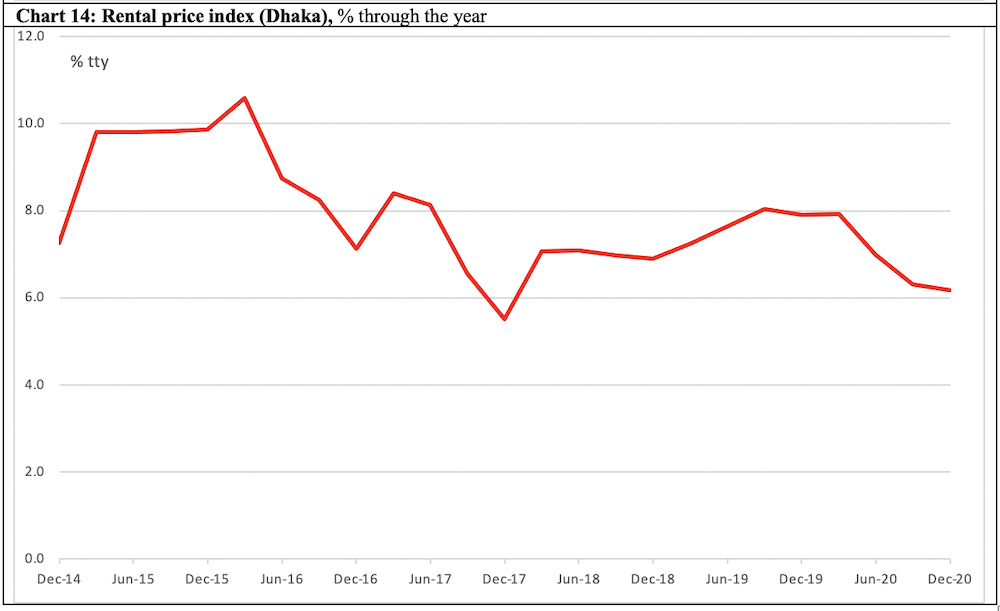

Chart 13 and 14: Price of rice and rental prices in Dhaka

Price of rice continued to rise steadily until December 2020 and rental price index in Dhaka continued to show a slowdown in last three months of data.

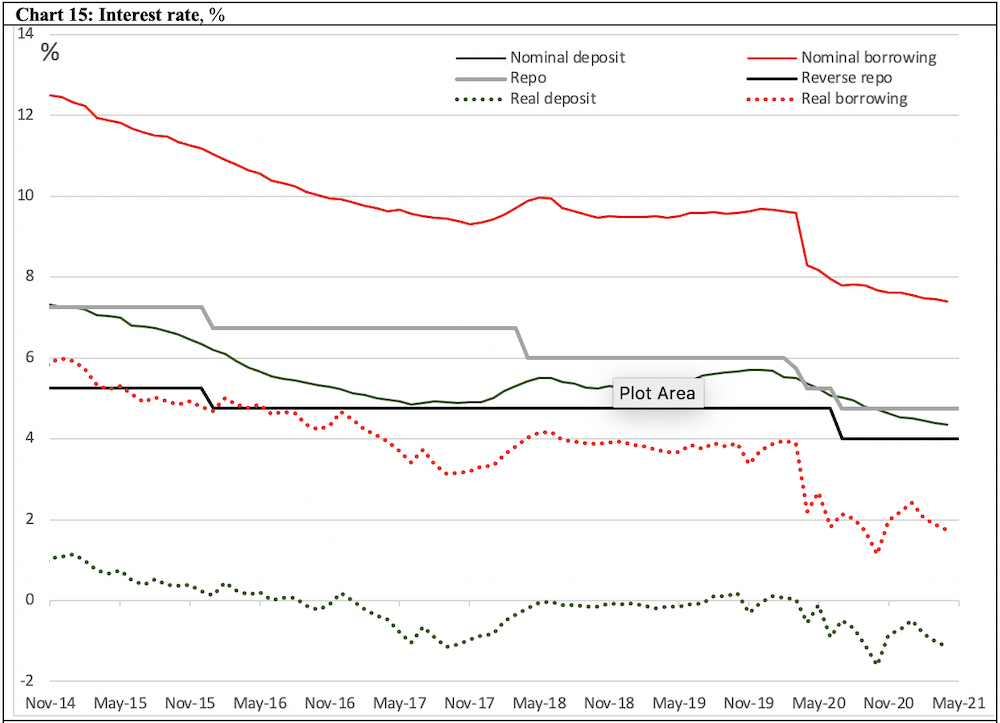

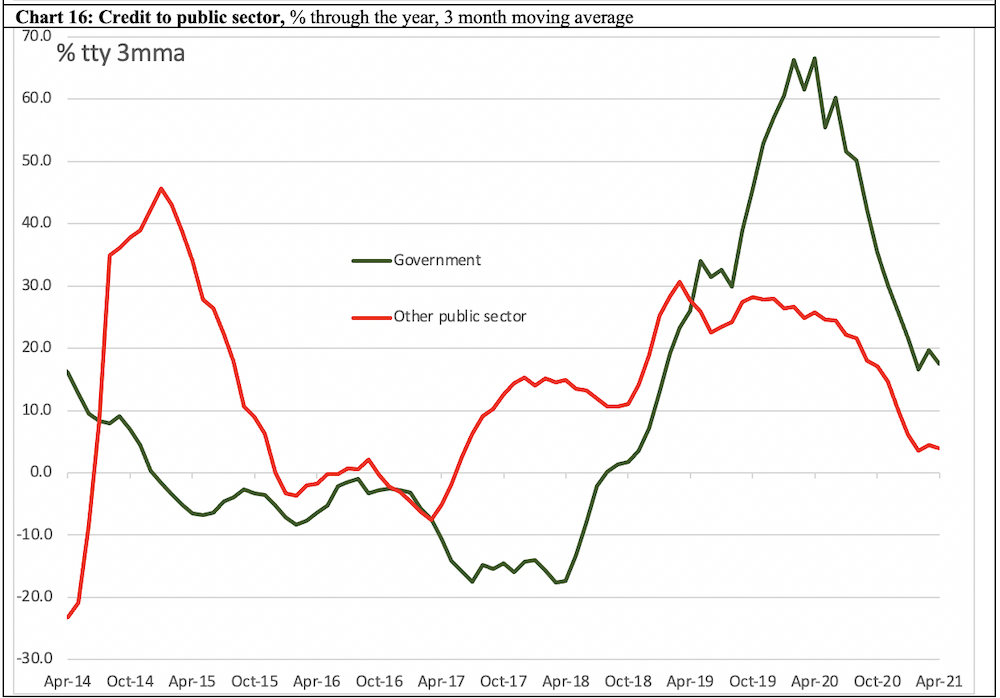

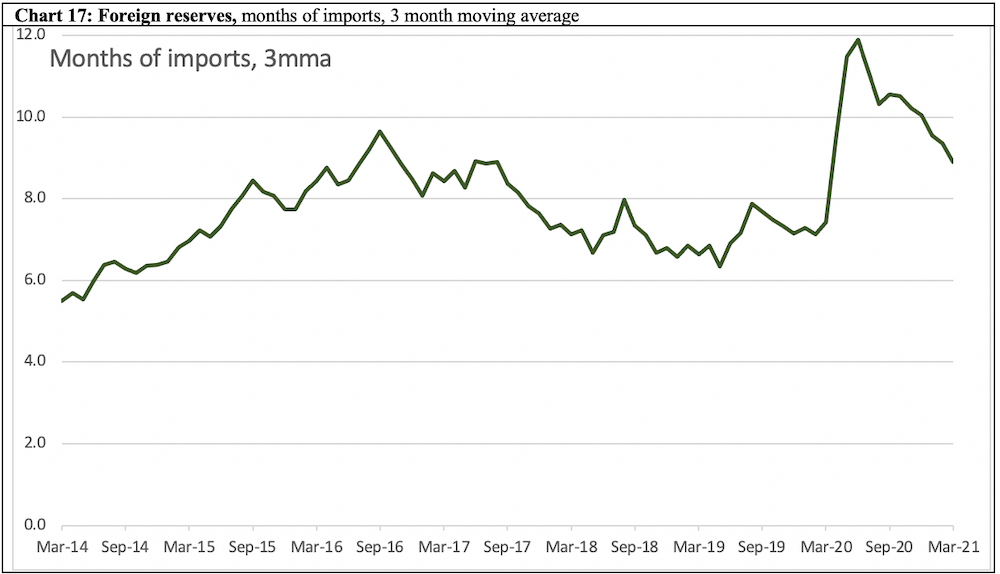

Charts 15, 16, 17: Interest rates, credit to public sector and foreign reserves

Both deposit and borrowing interest rates continue to tumble as of May 2021, which should support economic activities. Public sector borrowing has eased. As of March 2021, stock of reserves (expressed in months of imports) continue to be far above the three month buffer.

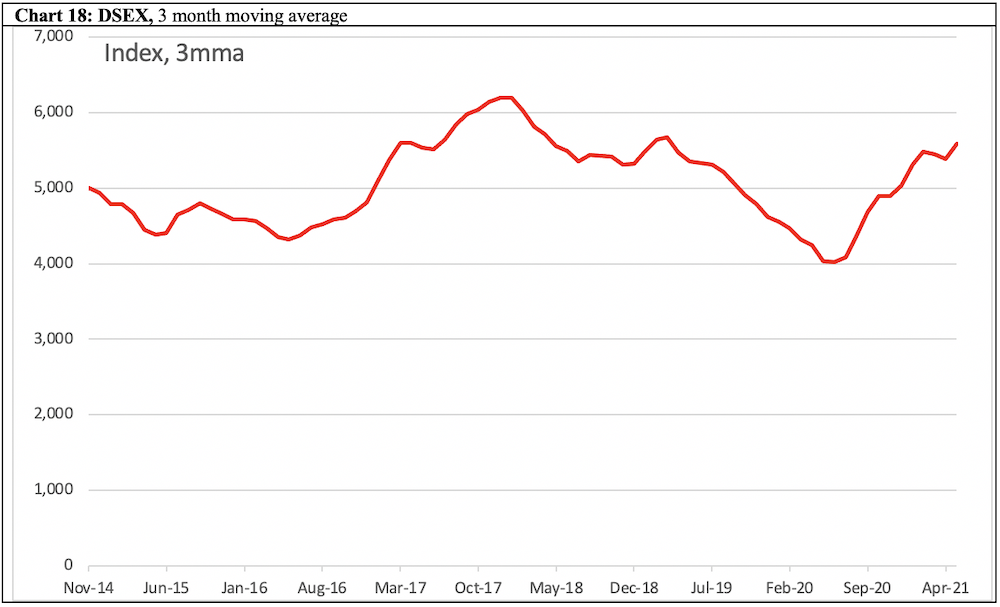

Chart 18: Stock market

The Dhaka Stock Exchange continues to rise as of May 2021 having fallen from mid-2019 and bottoming out in mid-2020.

Overall assessment

Bangladesh economy, already slowing before the Covid-19 recession, is yet to show any sign of a durable growth. That said, there were flickers of recovery in some indicators. Production as well as household demand appeared to have bottomed out by March-April (that is, before the latest lockdowns). Labour income appeared to be recovering, and food prices were stabilising towards the end of 2020. Policies are supportive of growth. Stock market appears to be optimistic.●

Jyoti Rahman is an applied macroeconomist. His analysis is available at www.jrahman.wordpress.com, and he can be contacted at [email protected].